COLORADO SPRINGS, Colo. (KOAA) — If you live in Colorado and continue to see your home insurance premium go up, you're not alone.

TheZebra.com, a company that specializes in insurance comparison, ranks Colorado number five as the most expensive state in the country when it comes to insurance premiums, with average annual costs at $4,586.

"It isn't always personal," Beth Swanson, an insurance analyst for TheZebra.com, told News5. "Sometimes it feels like an attack on your budget and your way of life. But thinking about it from a business perspective and a risk perspective, it's important to keep in mind that insurance companies are in business to help us with our risk, and they can only stay in business if they charge the appropriate amounts to help make up for the claims that people have. So basically, as risk increases, everyone's homeowners insurance and car insurance is going to continue increasing."

Swanson pointed to extreme weather to include wind and hail along with natural disasters such as wildfire for the biggest reason Coloradan's wallets are getting hit hard.

"One of the things that I take a look at a lot is the FEMA risk analysis on their website," Swanson explained. "They actually classify El Paso County as relatively moderate when it comes to their risk index for hail. However, it's relatively high, which is in comparison to the rest of the country. You know, wind, even a tornado. It might surprise people in El Paso County that the tornado rate is relatively high.... Wildfires. I mean, that's that's going to be one of the things that I'm a former Colorado resident, resident myself, so I understand what that is like to live thinking about the wildfires and the risk that they prevent present to homeowners in the area."

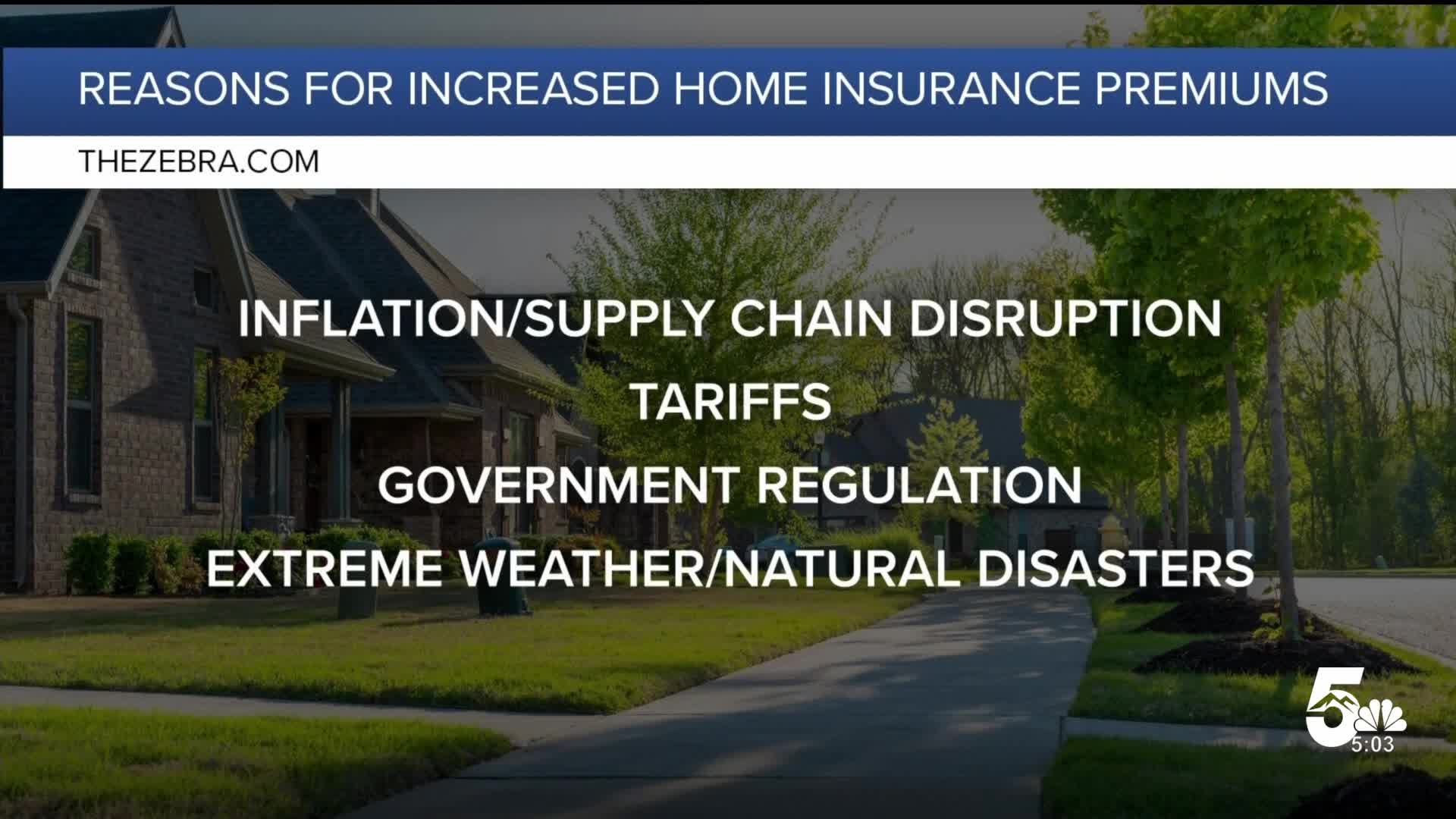

Findings from the report found several reasons for an increase in premiums:

- Inflation and supply chain disruption. Material goods (lumber, roofing materials, etc.) and construction prices have increased with inflation and factors like supply chain disruptions, making claims more expensive for insurance companies.

- Tariffs. The construction industry relies heavily on imported materials, meaning tariffs will likely lead to significant increases in the cost of rebuilding and repairing homes. As with other economic factors, insurance companies must raise rates to accommodate increased costs.

- Extreme weather and natural disasters. From hurricanes and wildfires to flooding, extreme weather has impacted homeowners across the country, leading to rising insurance costs.

- Government regulation. Insurance is a state-regulated industry, meaning the government can control how high insurance companies can raise rates. When it's a long time between rate increase approvals, it can lead to sudden jumps.

The growing population in the Centennial State also adds to an increase in home insurance premiums.

"I get it, I've been there," Swanson, a former Colorado resident, said. "But the more people are there, that means the more risk there's going to be as well. This is extremely prominent in car insurance as well. So you think about all the people on the roads, that means there's more risk for accidents. Home Insurance claims are going to be similar."

Swanson also had some tips for homeowners to help lower their premiums including:

- Bundling

- Simply asking your insurance agent if there are discounts

- Wildfire mitigation

- Home upgrades

- Shopping around and exploring smaller insurers

As for which state ranks the highest when it comes to home insurance premiums, TheZebra.com found Nebraska had the highest with an average of $7,920, and Oklahoma at number two with $7,426.

Click here to view the full report from TheZebra.com.

___

Owner speaks out after stolen vehicle involved in park incident and crash

The owner of a car that was stolen and driven through a park in Pueblo speaks.

____

Watch KOAA News5 on your time, anytime with our free streaming app available for your Roku, FireTV, AppleTV and Android TV. Just search KOAA News5, download and start watching.