EL PASO COUNTY, Colo. (KOAA) — Colorado is no stranger to hailstorms, and new data just released shows that hail risk is the biggest contributing factor to the state’s steep insurance premiums.

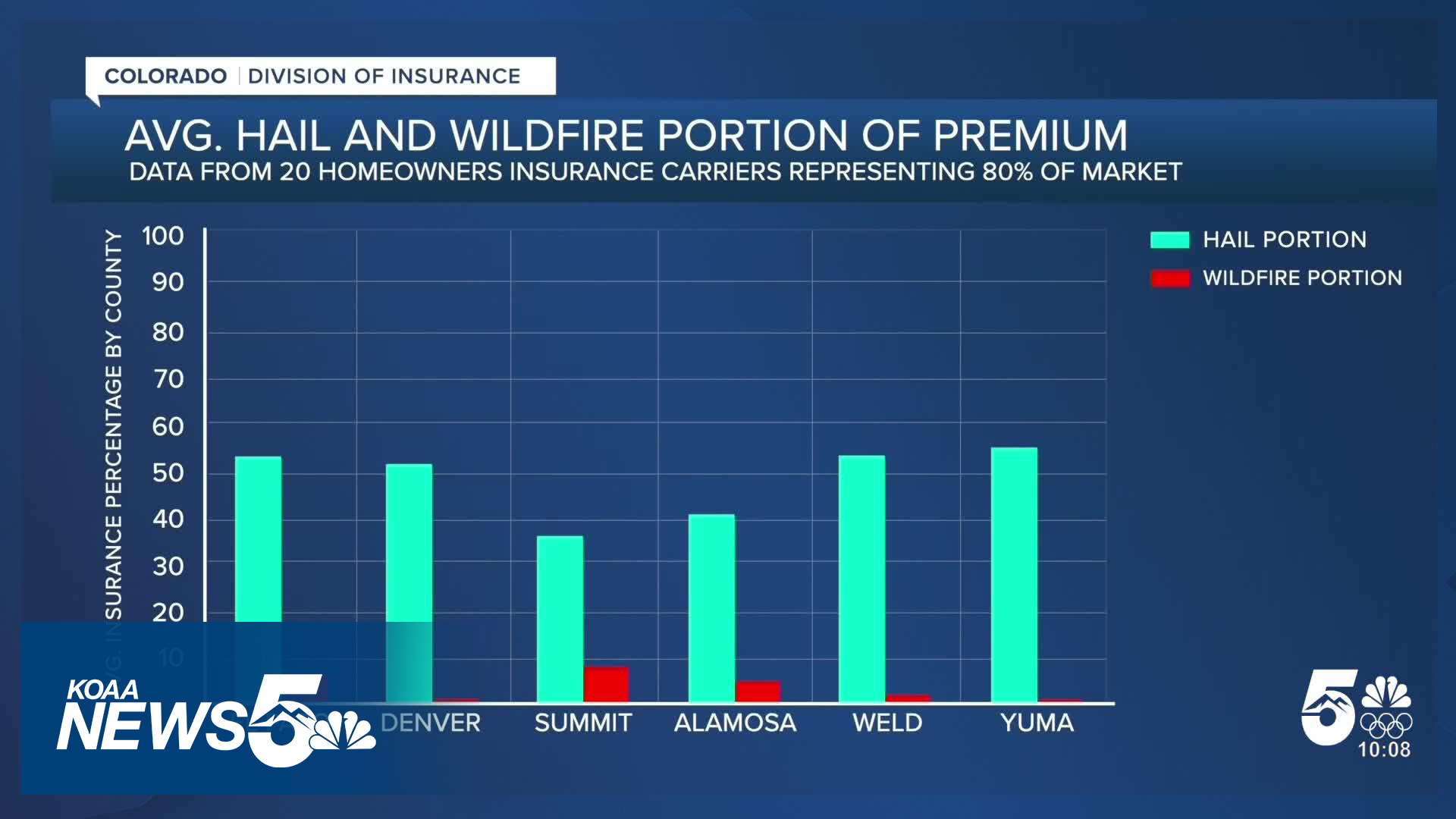

The data showed hail accounts for an average of 26% to 54% of total homeowner insurance premiums, depending on the county, according to a press release.

Governor Polis and the Colorado Division of Insurance (DOI) gathered data from 20 homeowner insurance carriers, representing 80% of the market, to calculate the average homeowner's insurance premiums for 11 counties.

In El Paso County, for example, hail risk accounts for 52.5% of a homeowner's insurance premium while wildfire risk makes up just 6%.

Even in counties without a severe hail risk, such as Summit County, where mountainous terrain and a lack of overall moisture prevent major hailstorms, the hail risk still accounts for 35.6% of premiums.

Wildfire risk represents anywhere from 0.9% to 24.6% of the cost in premiums, depending on the area.

“The data is clear: it is hail that is the biggest cost driver of homeowner insurance for families across the state. Even Coloradans who don’t live in hail-prone areas, such as in mountain communities, are paying for hail damage through their premiums,” said Colorado Insurance Commissioner Michael Conway in the press release.

“We can’t change the weather in Colorado, but we can and should help consumers in high-risk areas fortify their roofs because that will help lower everyone's premiums,” said Conway. “And we have to find innovative solutions to help address affordability in our high wildfire areas of the state. To that end, we’re working with the Colorado General Assembly again this year on legislation to create a grant program for fortifying roofs, as well as a reinsurance program for wildfires.”

Gov. Polis and Commissioner Conway are pushing for that possible legislation, but the draft has not yet been introduced, and the insurance industry hasn’t seen the language.

Carole Walker, executive director for the Rocky Mountain Insurance Association, said the new data isn’t surprising, but she cautions against the possible legislation having unintended consequences.

She said the insurance industry supports a state mitigation program to help increase the number of hail-resistant roofs, which would help lower premiums if done at a large scale.

But she said the funding could be the deciding factor on whether insurers support the legislation.

“We really need to have a serious conversation about how do we fund this before we pass a bill and put in a grant program where there's no sustainable long-term funding, or it's just going to be put back on the insurance company, which, if we're not allowed to pass it on to consumers, threatens insurance companies' solvency,” said Walker. “So insurance companies are going to have to be able to somehow pass on the cost if it's a fee to them.”

A recent study on impact-resistant shingles showed Colorado only makes up about 10% of the market share despite having the second most claims in the country. Texas, which ranks first, has 43% of the market share for the hail resistant roof shingles.

The DOI also noted if homeowners mitigated hail risk with better roofing, consumers could save an average of $82 to $387 annually on their premiums.

As for the potential reinsurance program for wildfires mentioned by Commissioner Conway in the press release, Walker said the state wouldn’t be able to afford the costs of major catastrophes.

A May 2017 hail storm in the Denver metro area caused about $3.3 billion in damages, adjusted for 2025 inflation, which is the state’s costliest catastrophe. But wildfires like the 2021 Marshall Fire cost $2.1 billion in 2025 dollars. And the 2012 Waldo Canyon Fire cost an estimated $641 million in today’s money.

“Getting into the business of insurance at a state level and creating one of these state-funded reinsurance programs, historically, has never worked in big states like Florida and California. There's never enough money in these reinsurance state funds to be able to handle a Marshall Fire, even a Waldo Canyon Fire,” she said.

“And what they're talking about right now, because we don't have an identified funding source for the reinsurance program, is just setting up a framework. For that reinsurance program, that makes us really nervous,” said Walker.

Residents threaten to move as 144-unit complex brings safety fears

A major apartment complex under construction is expected to bring 144 affordable housing units near North Carefree Circle and Peterson Road.