COLORADO SPRINGS — It's no secret that mortgage rates are quickly rising.

A little more than a year ago, home buyers could lock in rates under 3-percent. That's no longer the case, but is now the best time to hurry up and lock in a rate?

The housing market in Colorado Springs still appears hot with no immediate signs of slowing down.

Mortgage rates are still competitive, but experts say there's a few factors you should consider before pulling your credit.

In 2020, interest rates dropped below 3-percent for a fixed 30-year loan. Today, rates sit between 5 and 6-percent for most buyers with good credit.

"While the rate hikes seem high and they happened very quickly, they are still where they were prior to the pandemic," Shanon Schinkel, a loan originator with NFM Lending said.

She says while interest rates have soared in the last few months, it's not a time to panic.

"Most lenders have a lock and shop policy," she said. "If you’re not ready to buy right now, you can still lock in a loan for 60 to 90 days.”

Some lenders will even allow home buyers to lock in a loan for a longer term---giving you more security in this market.

However, Schinkel says it's more important for home buyers to do their research first by shopping around, comparing rates, and not necessarily going with the cheapest rate.

Here's why:

"Sometimes rates seem cheaper and may seem better, but not always," she said. " I’ve seen closing costs in the tens of thousands of dollars higher in order to secure that rate so be careful.”

Homes in the Pikes Peak Region are also selling above asking price and in some cases, above appraisal value.

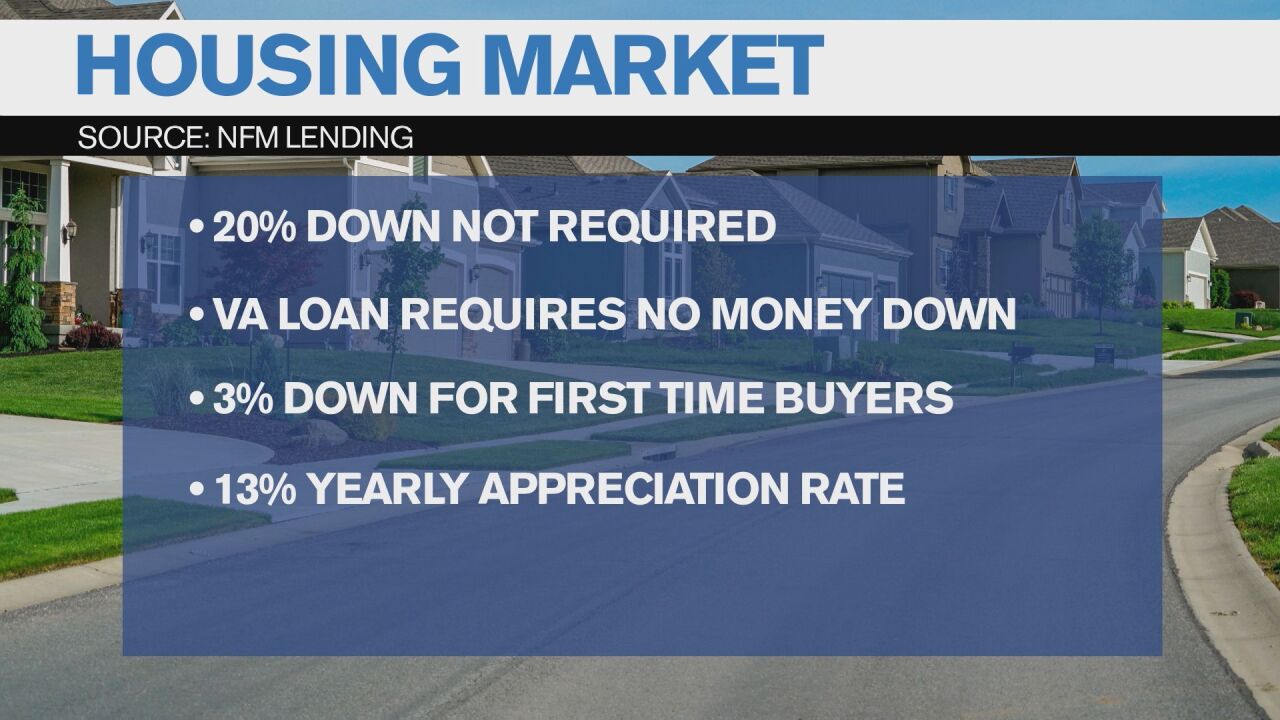

Without a 20-percent down payment or securing a mortgage through a VA loan, you'll likely end up paying private mortgage insurance (PMI).

PMI does increase your monthly payment and it's a cost you need to factor in with your loan.

“Mortgage insurance at one point was avoided like the plague because it was expensive and it added a lot to your monthly payment," she said. "Currently, it's not as expensive as it once was. Under current tax law, it is tax deductible so it’s not the kiss of death that it used to be. I would encourage people even with mortgage insurance to consider buying a house, even if you don’t have 20 percent down.”

Schinkel says the 20-percent down payment rule is a misconception.

You don't have to put a down payment with a VA loan, and first-time home buyers can secure a mortgage with as little as 3-percent down.

Schinkel says even with a 5-percent fixed 30-year loan, homes are appreciating by about 13-percent in the Pikes Peak Region every year.

For those who are skeptical or worried about a potential market crash and want to lock in a cheaper interest rate in the short term, an adjustable rate mortgage or "ARM" may sound more appealing. However, Schinkel says buyers need to use caution.

"An ARM will become more popular as rates rise," she said. " In the past couple of years they haven’t been because fixed 30-year loans were so low. As they rise, it is a way to save some money per month because the interest rates are lower because it’s fixed for a short period of time.”

If you only plan on living in a home for a few years, Schinkel says an ARM is an option on the table. She does warn that those rates can change by up to 5-percent after the fixed rate period is over, and that can leave some people in a bad situation if they plan to be in a home long term and cannot refinance.

In addition to interest rates, Schinkel says it's important to analyze all closing costs and fees. In the months leading up to a home sale, buyers should not have any major deposits, withdrawals or large purchases that could impact financing.

Need help calculating your mortgage payment? Click here for a free calculator tool.

For more information on how mortgage rates have shifted over the past several decades, click here.