COLORADO SPRINGS — Republican state lawmakers are urging Governor Jared Polis to call a special session to avert potentially painful property tax hikes next year following the defeat of Proposition HH.

On Thursday morning Governor Polis did just that. Calling for a special session to convene on November 17 at 9 a.m. to discuss property tax relief using $200 million already side, plus other options. Additionally, the Governor wants the General Assembly to address funding for a program to provide meals to school children of low-income families.

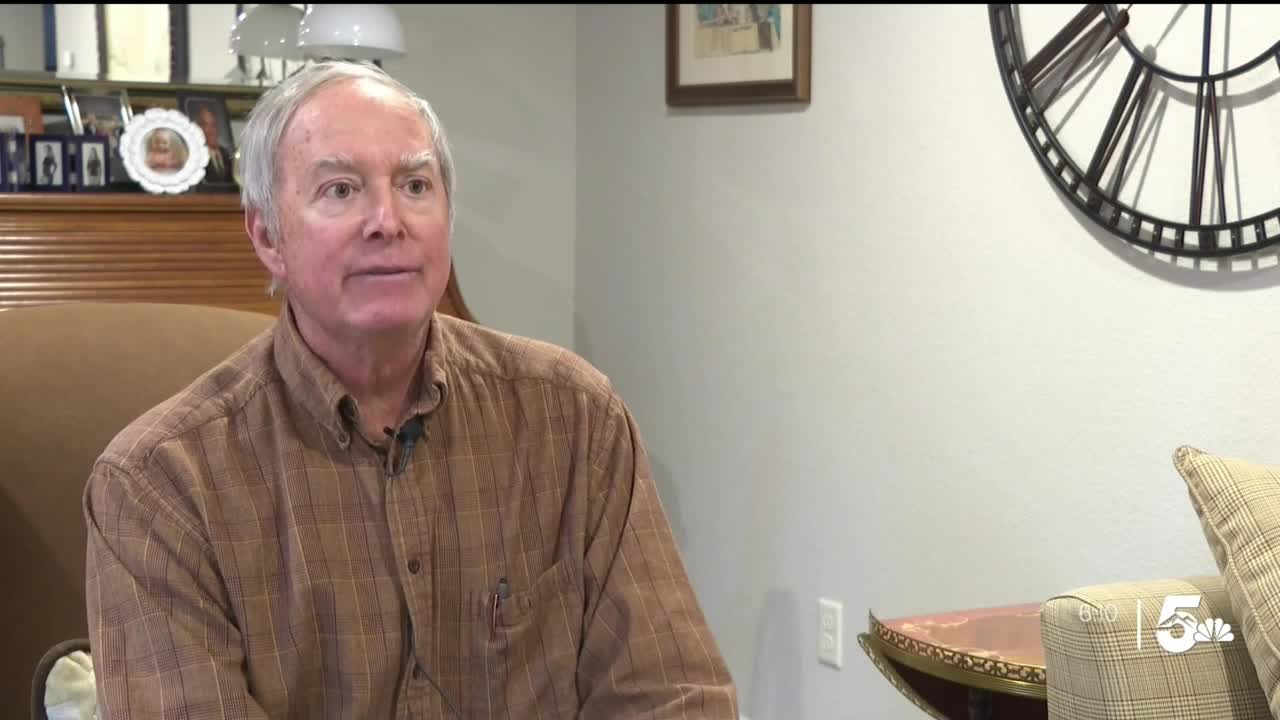

Senator Larry Liston of Colorado Springs has tried three times in the past two years to bring property tax relief for senior citizens and disabled veterans living on fixed incomes. He said his bills were defeated each time because of partisan politics.

His legislation sought to expand what's known as the Homestead Exemption. Colorado seniors can currently deduct up to $200,000 of value from their property tax assessments. Liston wants to increase that amount because of rising home values. His bills also would have expanded the law to include disabled veterans and made the exemption portable. Current law requires seniors to live in the same home for a decade to qualify.

"There were seniors that would be willing to move into a smaller home to allow younger families that were looking. So, it was a win-win situation."

He said he could never get his colleagues across the aisle to vote for it. The bills were defeated in committee on party-line votes.

The portability language was included in Proposition HH, although the home value deduction was unchanged. Liston said the bill that referred HH to the ballot lacked Republican support because of the way his Democratic colleagues rushed the legislation through.

Liston was not surprised to see Proposition HH fail. However, he believes the margin of defeat should send a strong message to the Governor and Democratic lawmakers that voters do not want to sacrifice TABOR refunds to address the problem.

He believes a 3-day special session would provide enough time to pass straightforward property tax relief before new appraisals take effect next year.

"We have a window of opportunity. We should seize it, and we should do it. We're prepared to do it," Liston said. "Our encouragement to the Governor is to call us, we'll be there on day one."

____

Watch KOAA News5 on your time, anytime with our free streaming app available for your Roku, FireTV, AppleTV and Android TV. Just search KOAA News5, download and start watching.