SIMLA, Colo. (KOAA) — A Colorado homeowner is warning others about a suspicious financial offer that he says nearly cost him everything he worked for.

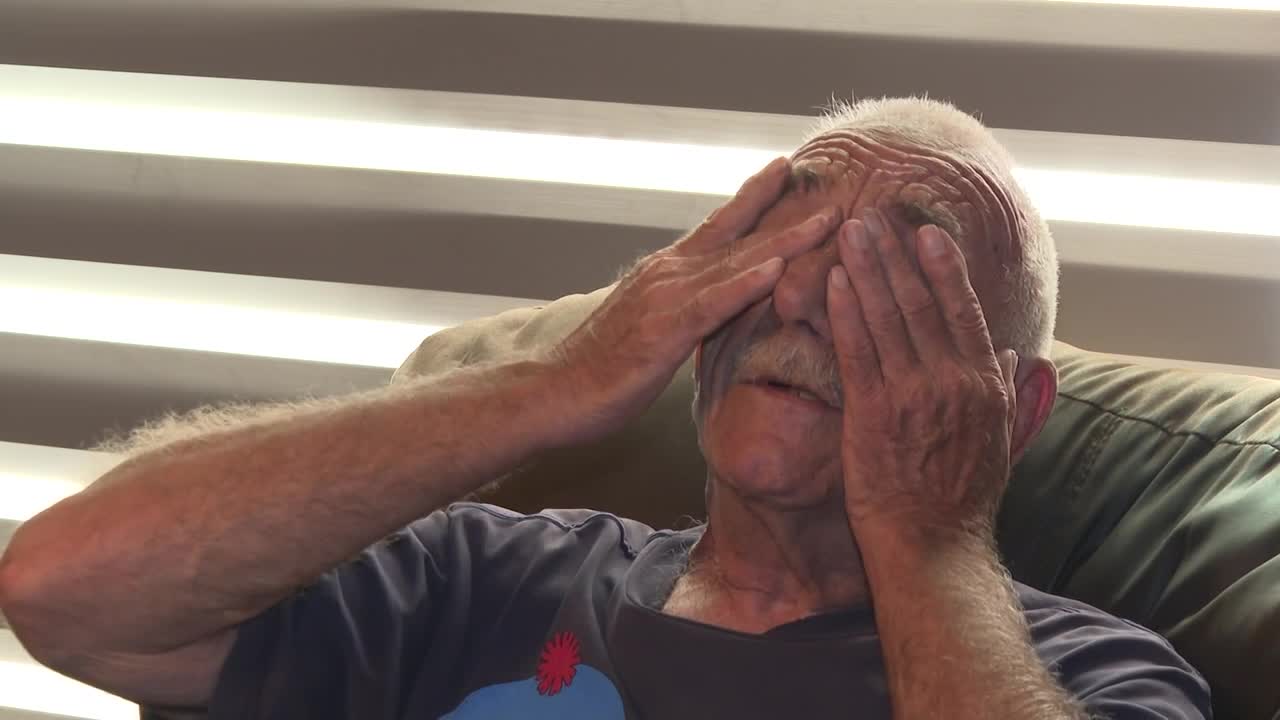

Jerry Owen, 77, of Simla, says what started as a simple online search for a loan to buy a new car, quickly spiraled into a scheme that could have put his home at risk.

“My dad told me when I was a teenager, if it sounds too good to be true, it usually is,” Owen said.

Owen said his original plan was to borrow $10,000 against his home in order to use the money to get a new car. But instead of him reaching out to a lender, he was surprised when what he thought was a loan company contacted him first.

“I sent them all my Social Security papers and documents. I sent them my bank statements,” Owen explained.

The company then sent him more than 100 electronic documents to sign.

“I didn’t even read them. I didn’t even see them because he said they were not that important,” Owen said.

The loan company told him that he qualified to borrow against his home for the car loan he was seeking. The company told Owen his home was worth $180,000 if he refinanced with them. However, that amount was far more than the $30,000 value Owen’s bank had previously given him.

He said the home value differences were a red flag, so he made an appointment with his bank to verify if the offer from the loan company was legitimate.

“I walked into the bank instead of drive-up, and I was telling one of the tellers about what was going on, and the president of the bank came out of her office in the corner. She told me, ‘It’s a scam,’” Owen recalled.

Owen stopped all communication with the company and did not go through with the loan process. He says the experience still makes him uneasy because he gave the company access to his personally identifiable information and signed unread documents.

“I guess there are a lot of people in this world that has no conscience. I couldn’t do that to somebody that worked their whole life to get their house…it just really upsets me,” Owen said.

Owen said he believes he came close to losing his home and hopes sharing his story will help others avoid the same mistake.

MORE | What to do if my info has been exposed?

The Federal Trade Commission (FTC) advises anyone who has shared personal information with a suspicious company to take immediate action:

- Inform your bank. They may recommend freezing or closing accounts and can help verify whether a loan offer is legitimate.

- Check your credit report for any signs of identity theft.

- Report the incident to the FTC and local authorities.

Officials say speaking up about suspicious financial activity can protect others from falling into similar traps. You can file a report with the FTC here.

This story was written by KOAA News5 Comsumer reporter Kierra Sam. Have a story? Send an email to Kierra.Sam@koaa.com.

Inside the 'Southeast Strong' Plan to Revitalize a Part of Colorado Springs

After years in the making, the "Southeast Strong" plan is ready for review. This report breaks down the key proposals, from attracting major retailers and supporting small businesses to creating new cultural centers.

____

Watch KOAA News5 on your time, anytime with our free streaming app available for your Roku, FireTV, AppleTV and Android TV. Just search KOAA News5, download and start watching.