The traditional belief that success and wealth hinge on earning a four-year college degree is being challenged as more teenagers opt for technical or vocational schools.

Spencer McDonald, 23, represents a growing number of students who have turned away from conventional college routes. Instead, he pursued a two-year technical degree.

"It was a no-brainer for me," McDonald said. "It was well more than half the price."

IN RELATED NEWS | Shift in values: High school grads flock to trade schools as confidence in traditional degrees wanes

Upon graduating in HVAC, he secured a job immediately. Within two years, he advanced to project manager at a construction site.

"When they say the sky is the limit, they truly mean the sky is the limit," McDonald added. "I've met guys making $250 an hour for running wire."

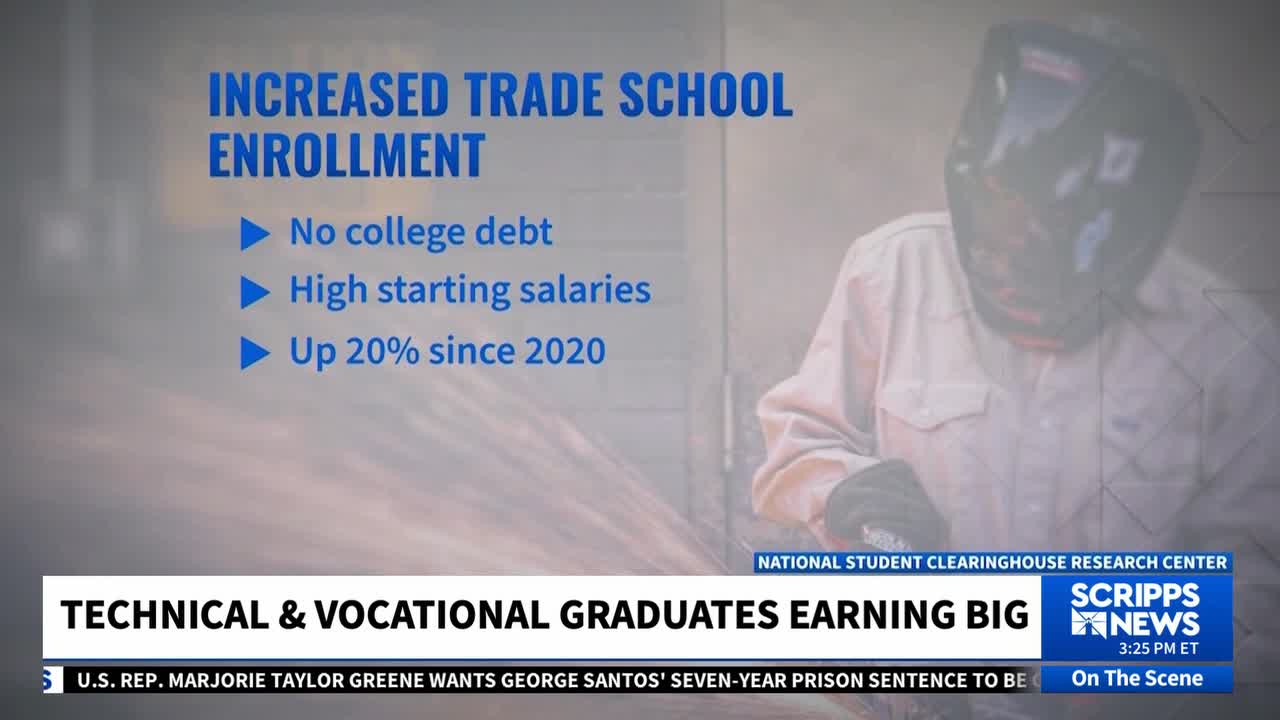

With no college debt and high starting salaries, it’s no wonder enrollment in vocational and trade schools has increased steadily by 20% since 2020. The Bureau of National Labor Statistics reports that entry-level skilled workers can earn between $50,000 and $62,000 annually or more.

However, higher salaries do not always equate to long-term financial security. Experts advise that this is when the need to save becomes crucial.

"When you zoom out 10, 15, 20 years, even starting four years early means that your money has compounded at a higher and longer rate. And that's powerful," said Stephen Kates, a financial analyst at Bankrate.

He recommends setting up multiple accounts with direct deposit before receiving your first paycheck.

IN CASE YOU MISSED IT | Age in America: Is there a 'magic number' Americans need to retire comfortably?

"Using the framework 50-30-20, or some amalgamation of that, you can choose the numbers that work for you," Kates explained. "But 50% for essential expenses, 30% for discretionary expenses, and 20% for savings."

McDonald practices these principles himself. He contributes to his 401k and invests a percentage of each paycheck while saving to buy a home and eventually several rental properties.

"My goal is to be retired by between 47- 53," he said.

This story was initially reported by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.